The metal injection molding market is projected to grow from 2.58 Billion in 2017 to USD 3.77 Billion by 2022, at a CAGR(Compound Annual Growth Rate) of 7.83% from 2017 to 2022. The growth of this market can be attributed to the increasing demand for small and complex metal injection molded parts from end-use industries, such as electrical & electronics, automotive, medical & orthodontics, industrial, consumer products, and firearms & defense.

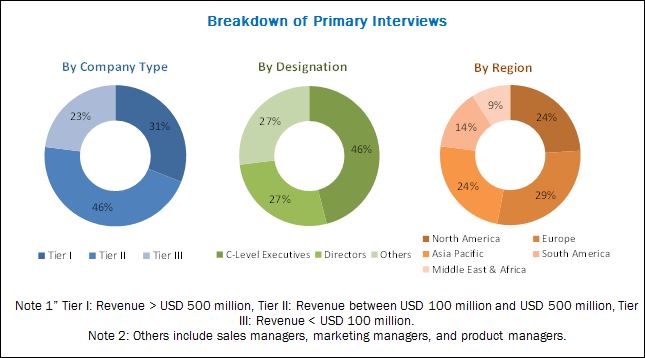

The size of the metal injection molding market was calculated, and weightages were assigned to various market segments. This was performed on the basis of extensive primary interviews and secondary research based on the information available on websites of various associations, such as Metal Powder Industries Federation, Powder Injection Molding International, and European Powder Metallurgy Association. Primary research included extensive interviews with key personnel, such as CEOs, VPs, directors, and executives of metal injection molding companies. After arriving at the overall market size, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures were employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of profiles of primary respondents is depicted in the figure below.

The metal injection molding market has been segmented on the basis of material type, end-use industry, and region. On the basis of material type, the market has been segmented into stainless steel, low alloy steel, soft magnetic material, and others (tungsten, tool steel, titanium). The stainless steel segment is estimated to be the fastest-growing material type segment of the metal injection molding market on account of the wide application of stainless steel in various end-use industries. Stainless steel is consumed widely owing to its relatively lower price as compared to other material types. This factor is expected to drive the demand for stainless steel during the forecast period.

On the basis of end-use industry, the metal injection molding market is segmented into electrical & electronics, automotive, industrial, consumer products, medical & orthodontics, and firearms & defense. The electrical & electronics segment is projected to grow at the highest CAGR between 2017 and 2022. This projected high growth is due to the rising demand for miniaturization of electronic devices, which has resulted in the increasing demand for small and complex metal injection molded parts with better performance at a relatively lower cost.

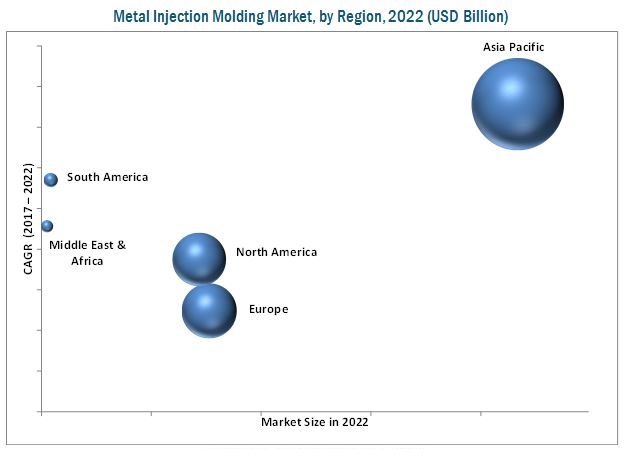

Based on region, the metal injection molding market has been segmented into North America, Europe, Asia Pacific, South America, and the Middle East & Africa. Asia Pacific is estimated to be the largest market for metal injection molding in 2017 and is expected to continue leading the market till 2022. The Asia Pacific metal injection molding market is also projected to be the fastest-growing market between 2017 and 2022. Growing demand from end-use industries, including automotive, electrical & electronics, medical & orthodontics, industrial, firearms & defense, is expected to drive the metal injection molding market in the region. Most of the key players operating in the metal injection molding market have their production facilities in this region since the production cost in this region is lower as compared to other regions.

The growing automotive industry in APAC and rising demand for miniaturization of consumer electronics are increasing the demand for small and complex metal injection molded parts. However, a major factor restraining the growth of the metal injection molding market is the high cost of the metal injection molding process for small production capacities.

New product launches and expansions were the major developmental strategies adopted by key players operating in the metal injection molding market between 2013 and August 2017. Key companies adopted these strategies to enhance their product offerings and customer base as well as to gain a competitive edge over their peers in the market. These companies are also focused on investing in research & development activities to introduce new and cost-effective materials to keep up with the changing consumer needs.